Unbanked individuals face financial challenges due to limited access to traditional services. Title loans offer a solution with flexible terms and lower rates compared to payday loans, providing quick funding through vehicle equity collateral. However, unbanked customers should be aware of high-interest rates and repossession risks, exploring options like motorcycle title loans or seeking financial advice for informed decisions.

“Car title loans have emerged as a lifeline for many unbanked households, offering quick access to much-needed funds. This article delves into the unique financial struggles faced by unbanked customers and how title loans provide an alternative solution. We explore the benefits and considerations of this option, shedding light on its potential to empower individuals who lack traditional banking services. Understanding these dynamics is crucial in gauging the impact of title loans on serving unbanked communities.”

- Understanding Unbanked Households and Their Financial Struggles

- How Car Title Loans Provide Access to Quick Funds

- Benefits and Considerations for Unbanked Customers Seeking Title Loans

Understanding Unbanked Households and Their Financial Struggles

Unbanked households, a growing segment of society, face unique financial challenges due to a lack of access to traditional banking services. These individuals often rely on alternative financial institutions for their monetary needs, which can lead to higher-interest rates and fees. The term “unbanked” refers to people who either have never had a bank account or have inactive ones, making it difficult for them to manage their finances securely and efficiently. This demographic is particularly vulnerable during economic downturns or unexpected crises, as they may struggle to access emergency funds or credit when needed most.

These financial struggles can be attributed to various factors, such as limited income, poor credit history, or a lack of proper identification documents. In such situations, a title loan can serve as a viable option for unbanked customers. By leveraging the value of their assets, like a vehicle’s title, individuals can secure a loan with more flexible terms and lower interest rates compared to payday loans or other short-term financing methods. The Title loan process provides an opportunity for refinancing existing debts or covering immediate expenses, offering a much-needed financial safety net. Even alternatives like motorcycle title loans can provide access to capital for those who own valuable vehicles but are unbanked.

How Car Title Loans Provide Access to Quick Funds

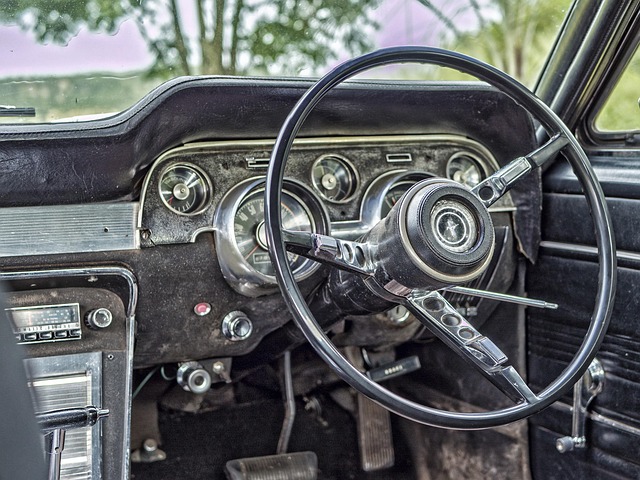

Car title loans offer a unique solution for individuals who are unbanked or have limited access to traditional financial services. This alternative lending method provides a quick way for borrowers to gain emergency funding by using their vehicle’s equity as collateral. The process is designed to be efficient, with quick approval times, often within the same day. Borrowers simply present their car title and drive off with much-needed cash in hand.

One of the significant advantages for unbanked customers is that it bypasses the strict eligibility requirements of bank loans. Unlike traditional loans that rely heavily on credit scores and extensive documentation, car title loans focus primarily on the vehicle’s value and the borrower’s ability to repay based on their income. This makes it accessible to those with limited credit history or no credit at all. Additionally, loan refinancing options can be explored later if needed, providing flexibility for borrowers to adjust repayment terms according to their financial capabilities during different stages of life.

Benefits and Considerations for Unbanked Customers Seeking Title Loans

For unbanked customers lacking traditional banking access, car title loans offer a unique solution to bridge financial gaps and secure emergency funds. This alternative lending option provides an opportunity for individuals without a bank account or credit history to gain immediate liquidity by using their vehicle ownership as collateral. It’s particularly beneficial during unforeseen circumstances, such as medical emergencies or unexpected repairs, where quick cash is needed.

When considering a title loan, unbanked customers should be aware of the process and associated costs. While it can offer fast approval and access to capital, high-interest rates and potential repossession risks are considerations. Exploring options like motorcycle title loans or seeking guidance from financial advisors can help unbanked individuals make informed decisions regarding their vehicle ownership and ensure they receive the best terms for their situation.

Car title loans have emerged as a valuable tool to support unbanked households, offering them access to much-needed funds during financial emergencies. By leveraging their vehicle’s equity, unbanked customers can gain quick and easy access to cash, providing a bridge until they can stabilize their finances. While this alternative financing option offers several benefits, it’s essential to approach title loans thoughtfully, considering the potential risks and ensuring responsible borrowing practices to help unbanked individuals navigate financial challenges effectively.