Unbanked individuals face challenges accessing traditional financial services, prompting them to turn to alternative lenders. Title loans have emerged as a significant solution, allowing borrowers to tap into their vehicle equity for quick funding with minimal credit checks or paperwork. This method provides urgent financial support and helps unbanked customers build or restore their financial standing. In the digital era, title loans offer a revolutionary approach to meet the unique needs of unbanked clients.

In today’s fast-paced world, unbanked individuals often face challenges accessing traditional financial services. This is where title loans step in as a crucial solution, providing quick approval systems that offer much-needed capital. Our article explores how these innovative financing options serve as a financial lifeline for unbanked customers, highlighting the benefits of their streamlined approval process. We delve into empowering access to capital for all, ensuring that those without banking access can still achieve their financial goals.

- Unbanked Individuals' Financial Lifeline

- Title Loans: Quick Approval Process Explained

- Empowering Access to Capital for All

Unbanked Individuals' Financial Lifeline

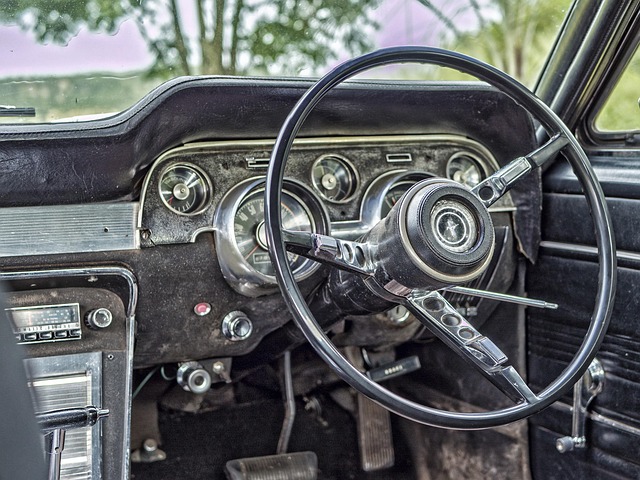

For many unbanked individuals, traditional financial services often fall short, leaving them without access to basic banking and credit options. This demographic relies on alternative lenders to bridge their financial gaps. Title loans, specifically, have emerged as a crucial lifeline for those lacking established credit or bank accounts. These loans are secured against an individual’s vehicle equity, providing quick access to funds for emergency expenses or unexpected financial needs.

Without the need for extensive credit checks or lengthy application processes, title loans offer same-day funding, catering to the urgent requirements of unbanked customers. This accessibility is particularly beneficial for those in employment but lack the traditional financial infrastructure, enabling them to manage unforeseen events without delay.

Title Loans: Quick Approval Process Explained

For unbanked individuals or those with limited access to traditional banking services, Title Loans offer a unique and appealing solution due to their swift approval process. Unlike conventional loans that often involve lengthy applications and strict credit checks, title loans provide an alternative for borrowers who may not have a strong credit history. The approval criteria focus more on the value of the borrower’s asset, typically their vehicle, than their financial background.

This streamlined approach enables unbanked customers to gain access to much-needed funds quickly. Lenders assess the loan amount based on the vehicle’s market value and the customer’s ability to make flexible payments. With no need for extensive credit checks, this process is particularly beneficial for those with limited or no credit, allowing them to build or restore their financial standing while meeting their immediate monetary needs.

Empowering Access to Capital for All

In today’s digital era, traditional financial systems often fail to cater to the needs of unbanked or underbanked customers. These individuals, who lack access to mainstream banking services, face challenges in accessing capital for various opportunities and emergencies. Title loans emerge as a game-changer in this context, offering a unique solution for these unbanked customers to gain immediate financial support.

By providing fast approval systems, title loan services empower individuals to take control of their financial destinies. This alternative lending method assesses the value of a customer’s vehicle through a simple process, often involving a quick vehicle valuation and an efficient loan payoff calculation. Unlike traditional loans with lengthy application processes, these titles loans offer flexible payment plans tailored to the borrower’s needs, ensuring accessibility for all.

Title loans have emerged as a powerful tool, offering quick approval systems that provide much-needed financial support to unbanked individuals. By leveraging their assets, these borrowers can gain access to capital swiftly, empowering them to navigate financial challenges and secure a brighter future. This alternative lending solution bridges the gap for those excluded from traditional banking services, demonstrating that everyone deserves equal opportunities when it comes to accessing credit.